maryland digital ad tax effective date

Sales tax due on March April and May sales of digital products or digital codes are due to the state by July 15 2021. On february 12 2021 the maryland general assembly voted to override governor larry hogans veto of.

The Lean Marketing Funnel Optimizes Conversion From Visitor To Customer Zooseo Marketing Social Media Marketing Sales Marketing Inbound Marketing

Maryland to implement digital ad services tax.

. The Digital Ad Tax is imposed on a businesss annual gross revenues defined as income or revenue from all sources before any expenses or taxes computed according to generally accepted accounting principles derived from digital advertising services in Maryland. Of February 12 2021 is later than the effective date of July 1 2020 HB 732 now becomes effective March 14 2021 and appl ies to taxable years beginning after December 31 2020. The state Senate Monday overwhelmingly passed SB.

18 2021 748 PM. 732 imposes a tax on a persons annual gross revenues derived from digital advertising services in Maryland. Digital Products and Digital Codes The new legislation excludes certain prerecorded and live instruction seminars discussions or similar events from the definition of a digital product.

Rate Global Annual Gross Revenues. The statutory references contained in this publication are not effective until March 14 2021. Three Issues with Proposed Regulations for Marylands Digital Advertising Tax.

Marylands new tax is a law and it will be implemented. The statutory references contained in this publication are not effective until march 14 2021. As mandated by the Maryland Constitution the tax will take effect in 30 days.

Key aspects of Marylands new tax The newly enacted tax law defines digital advertising services to. Maryland Digital Advertising Tax Rate Schedule Under SB. The Comptroller of Maryland does not expect to issue additional guidance for the digital advertising services tax until at least July 2021.

Legal challenges have already been filed alleging that the new tax violates the federal Internet Tax Freedom Act PL. Maryland Digital Advertising Services TaxImplementation Delay Likely. The tax on digital advertising services also takes effect March 14 and applies to all taxable years beginning after December 31 2020 but lawmakers are considering a measure SB 787 that would push the effective date back to January 1 2022.

The tax is applicable to all taxable years beginning after December 31 2020. One is a sales tax on digital products and the other is a digital advertising tax. Overriding the governors veto of HB.

There are however uncertainties concerning the laws viability and. 29 to explain what is considered a digital product or digital code. Effective March 14 2021 the Maryland sales and use tax applies to the sale or use of a digital product or a digital code.

First the effective date of the digital advertising tax is delayed to january 1 2022. Digital products including software-as-a-service are subject to Maryland sales tax as of March 14 2021. The new tax had been approved by the states legislature in early 2020 but rather than signing HB 732 into law Governor Hogan rejected the bill noting that it would be unconscionable to raise taxes and fees during.

732 2020 the Maryland Senate on February 12 2021 passed the nations first state tax on the digital advertising revenues. Effective on January 1 2022 the digital advertising tax is imposed on the annual gross revenues of a person derived from digital advertising services in Maryland. Tuesday March 2 2021.

Effective for tax years beginning after Dec. The tax will apply to any company that meet two thresholds 1000000 of gross revenues in Maryland derived from digital advertising services and 100000000 of global annual gross revenues. The tax rate varies from 25 to 10 depending on a companys global annual gross revenues.

100 million to 10 billion. The tax rate is not determined with. 10 billion to 50 billion.

Marylands Digital Advertising Gross Revenues Tax HB 732 was voted into law by the states General Assembly on Feb. On February 12 2021 Marylands General Assembly enacted two bills over the veto of Gov. Digital products and codes are subject to sales tax effective March 14 2021.

Ulrik Boesen Jared Walczak. At that date the sales and use tax rate on a sale of a digital product or a digital code is 6. Maryland has now enacted the nations first gross receipts tax targeted on digital advertising.

Wednesday March 17 2021. More than 150 billion. The first bill HB.

Maryland Delays Effective Date of Pioneering Digital Ad Tax. Big Tech Challenges Marylands Pioneering Digital Ad Tax 1 Feb. The first estimated quarterly payment at least 25 of the reasonably estimated tax based on 2021 Maryland digital ad tax revenues.

2 The regulations provide a. 787 which delays and modifies the Digital Advertising Gross Revenues Taxa tax of up to 10 on the gross revenue of internet advertising giants such as Google and Facebook Inc. An apportionment fraction is to be used to determine the annual.

50 billion to 150 billion. On the morning of Friday February 26 2021 the Maryland Senate Budget and Taxation Committee. Maryland Digital Advertising Tax Rate Schedule.

932 expands the existing sales and use tax base to include digital products effective March 14 2021. Earlier this year Maryland legislators overrode Governor Larry Hogans R veto of HB732 approving a digital advertising tax the first of its kind in the country. 1 This tax which is intended to be imposed on the annual gross receipts derived from certain digital advertising services provided in Maryland became effective on Jan.

105 - 277 and the US. On 12 February 2021 the Maryland legislature overrode Maryland Governor Larry Hogans veto of legislation HB 732 that imposes a new tax on digital advertising. It is scheduled to take effect by March 14 and that seems unlikely to change as of today.

April 12 2021 928 PM. The Maryland Comptroller recently issued final regulations interpreting the Maryland digital advertising services tax. Digital Taxes Are Here to Stay Regardless of Maryland Outcome.

March 30 2021 800 AM. The Maryland Department of Revenue issued Business Tax Tip No. Larry Hogan that make major changes in the states tax code.

Maryland Digital Advertising Tax Regulations Tax Foundation Comments

Pin On Create Digital Signature Online

Music Business Proposal Template Google Docs Word Psd Pdf Template Net Business Proposal Template Business Proposal Proposal Templates

Smile Digital Print Print At Home Digital Art Dentist Etsy Dental Fun Facts Medical School Inspiration Digital Prints

Maryland Digital Advertising Tax Regulations Tax Foundation Comments

13 Key Financial Terms Every Business Owner Should Know Business Financial Key Owner Terms More A In 2022 Accounting Services Business Tax Business Bank Account

10 Effective Types Of Explainer Videos Explainer Videos Corporate Videos Animation Explainer Video

Maryland Digital Advertising Tax Regulations Tax Foundation Comments

Digital Marketing Quotes Social Media Inspirational Business Posts Entreprene Digital Marketing Quotes Marketing Quotes Social Media Marketing Quotes

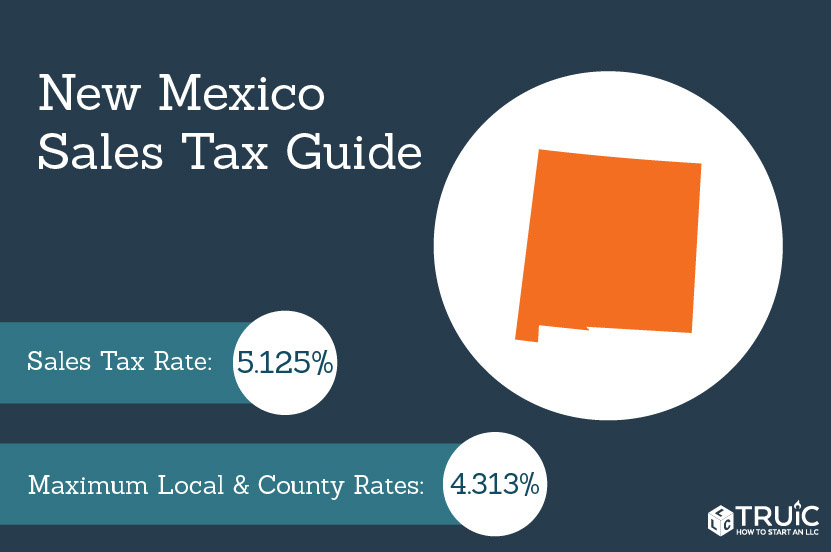

New Mexico Sales Tax Small Business Guide Truic

Tatiana Bozovic Seo Digital Services Lead Generation Lead Generation Digital Marketing Digital Marketing Services

Connect With Microsoft Partner Alireaz Branding Services Branding Agency Brand Guidelines

Top 10 Tax Tips For The Self Employed Already Know But This Is Handy Bookkeeping Business Small Business Bookkeeping Business Finance

Top 10 Tax Tips For The Self Employed Already Know But This Is Handy Bookkeeping Business Small Business Bookkeeping Business Finance

Michigan Real Estate Power Of Attorney Form Power Of Attorney Form Power Of Attorney Power