tax minimisation strategies for high income earners

TAX MINIMIZATION STRATEGY EXAMPLE 2. Ad We Work with Top Leading Tax Relief Firms.

10 Tax Planning Strategies For High Income Earners Gamburgcpa

6 Tax Strategies for High Net Worth Individuals.

. Depending on your province of residence you may be subject to tax at a rate of 50 or higher when your income exceeds 200000. Individuals are entitled to claim deductions for expenses directly related to earning taxable income. Here are 50 tax strategies that can be employed to reduce taxes for high income earners.

There are several ways to reduce the tax you pay. As a general overview the most beneficial strategies for tax minimisation are. To claim a work- related.

Your mortgage interest on a loan up to 750000 is a line item for itemizing deductions. Both are studying and will continue education for another 5. Take 60 Seconds To See If You Qualify For A Free Expert Tax Relief Consultation.

Because his income is so high any extra income will be taxed at the highest rate currently at 465. Protect your family from untimely death with income tax-free death benefit. Ad Filing your taxes just became easier.

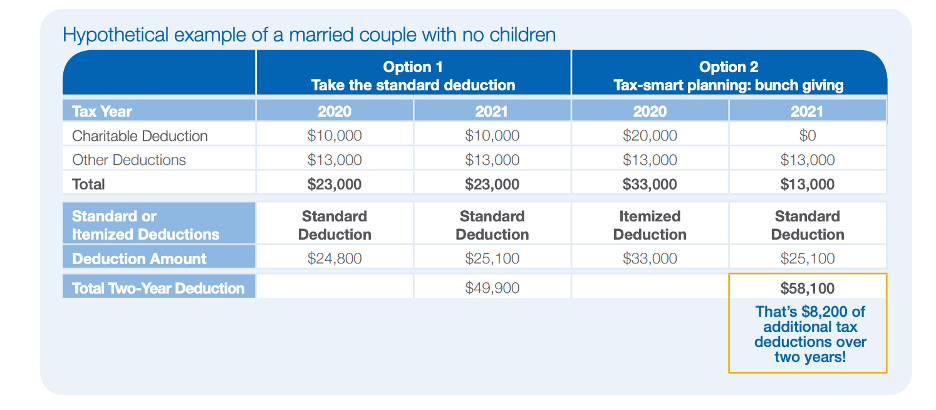

I help a couple local friends with technical aspects of their Tax and Accounting business. Gifts and donations to charitable organizations are one of the most common tax reduction strategies for high-income earners because they create a win-win situation for all. Find Out Which One Is The Best For Your Issue.

Your mortgage interest on a loan up to 750000 is a line item for itemizing. Tax Minimization Strategies for High Income Earners. Tax Advice for High Income Earners.

This article highlights a non-exhaustive list of tax. Max out Retirement Accounts and Employee Benefits. How to Reduce Taxable Income.

New Look At Your Financial Strategy. Because she stays at home she. Im not a CPA myself but one of their recent articles I found particularly helpful which.

File your taxes stress-free online with TaxAct. If you are a high-income earner it is sensible to implement. On the other hand tax avoidance is the use of illegal strategies or the non.

Structuring your business and personal assets. Visit The Official Edward Jones Site. Find Out Which One Is The Best For Your Issue.

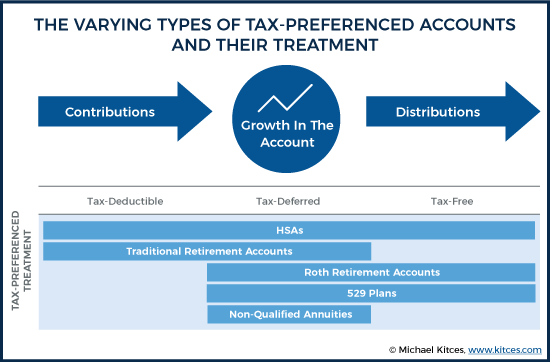

Creating retirement accounts is one of the great tax reduction strategies for high income earners. Dont let your taxes become a hassle. Tax minimisation is using legal strategies to reduce your personal tax burden.

Ad Designed With Resiliency in Mind to Help Handle Market Challenges. Take 60 Seconds To See If You Qualify For A Free Expert Tax Relief Consultation. Seek Out Income Generating Opportunities Globally.

Ad No Money To Pay IRS Back Tax. Qualified Charitable Distributions QCD 4. File your taxes at your own pace.

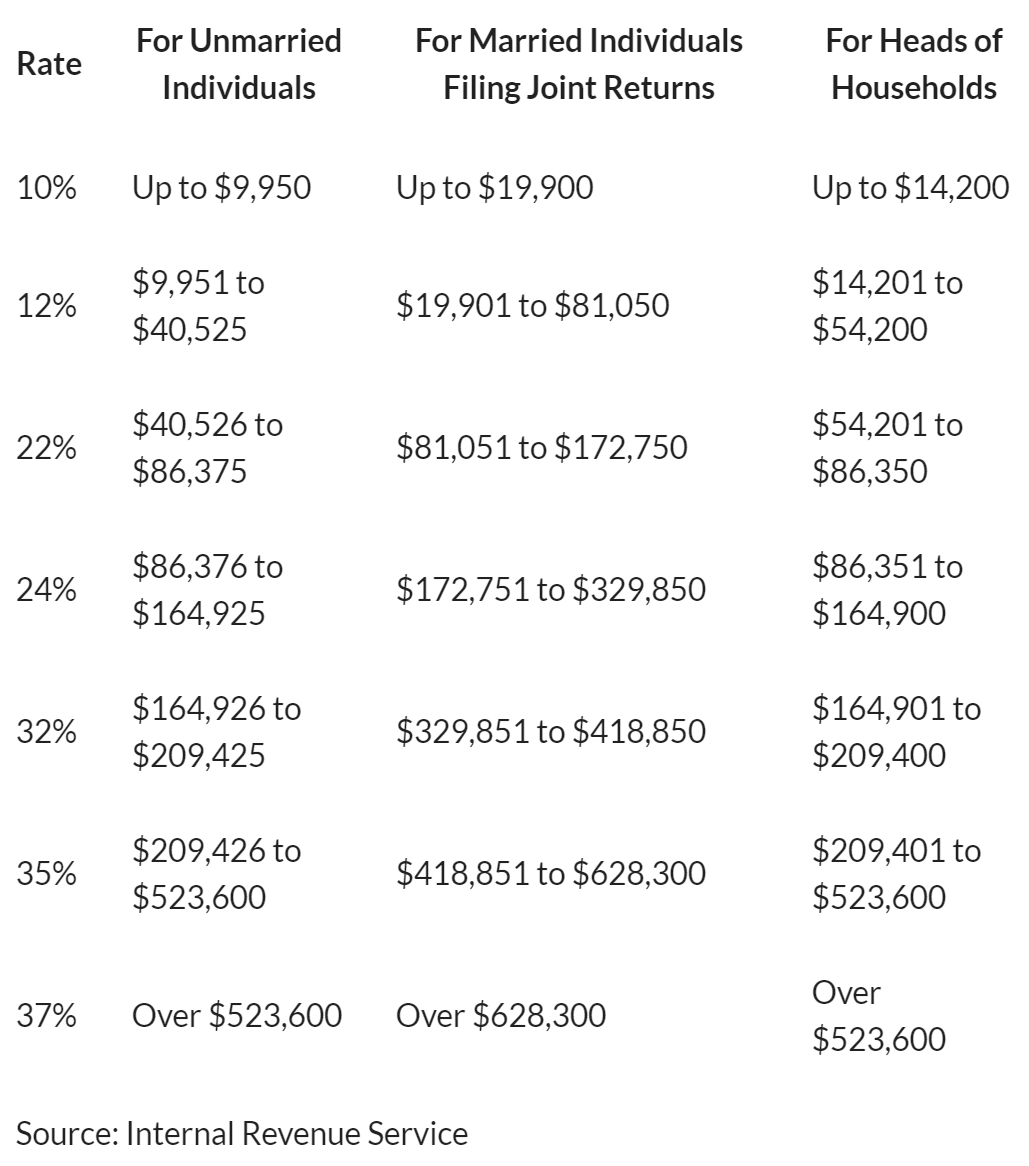

Answer 1 of 5. 50 Best Ways to Reduce Taxes for High Income Earners. The higher your income tax bracket the more beneficial this itemization is for you.

Do Your Investments Align with Your Goals. Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account. In fact if youre earning in excess of 180000.

If you are a high-income earner it is sensible to implement tax minimisation strategies. We provide guidance at critical junctures in your personal and professional life. The beauty of tax planning lies in its ability to reduce taxes throughout the year not just at year-end.

Find a Dedicated Financial Advisor Now. Ad We Work with Top Leading Tax Relief Firms. Using a Discretionary Trust to reduce taxes.

Ad Tax Strategies that move you closer to your financial goals and objectives. If you are an employee. After reviewing your current situation and financial goals we will pursue a combination of.

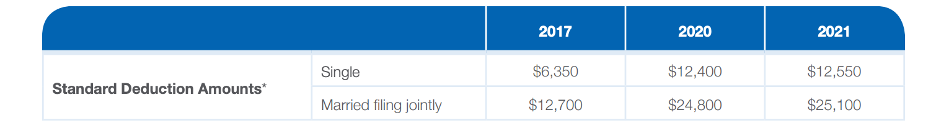

5 Outstanding Tax Strategies For High Income Earners Ad From Simple To Complex Taxes Filing With TurboTax Is Easy. In 2022 taxable income can be reduced for contributions up to 20500 to a 401 k or 403 b plan up from 19500 in. Effective tax planning with a qualified accountanttax specialist can help you to do.

So the money was distributed to Mary. Jane earns 230000 salary per year and has 2 adult children of 19 and 18. Tax planning through tax minimization strategies is ultimately beneficial to high-income earners when done under the guidance of tax accountants and CPA accountants.

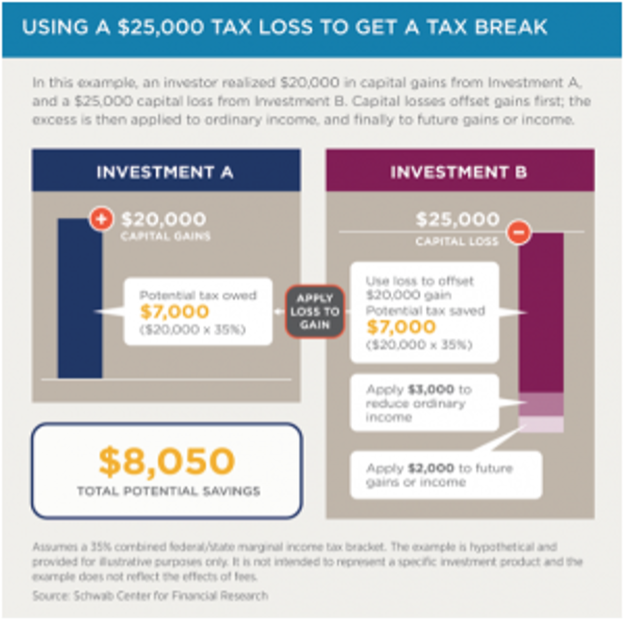

These are considered long-term capital gains and are taxed at preferential tax rates of either 0 15 or 20 depending on the individuals income level. 7 Ways to Prepare for.

4 Important Tax Strategies For High Income Earners

5 Outstanding Tax Strategies For High Income Earners Debt Free Dr Dentaltown

5 Outstanding Tax Strategies For High Income Earners

5 Outstanding Tax Strategies For High Income Earners

Tax Strategies For High Income Earners Pillar Wealth Management

Tax Minimisation Strategies For High Income Earners

The 4 Tax Strategies For High Income Earners You Should Bookmark

Tax Strategies For High Income Earners Wiser Wealth Management

Tax Strategies For High Income Earners Wiser Wealth Management

Tax Strategies For High Income Earners Pillar Wealth Management

Tax Strategies For High Income Earners Taxry

Tax Strategies For High Income Earners Taxry

Tax Strategies For High Income Earners 2022 Youtube

The 4 Tax Strategies For High Income Earners You Should Bookmark

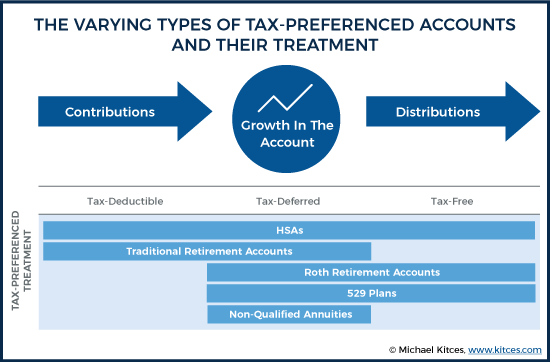

The Hierarchy Of Tax Preferenced Savings Vehicles

Tax Strategies For High Income Earners Pillar Wealth Management

Tax Reduction Strategies For High Income Individuals In 2021 Youtube

Tax Strategies For High Income Earners Wiser Wealth Management